It helps determine a trend’s end and the beginning of a new one. The first has a fairly large body, and the second is small, similar to Doji. At the same time, the second bar shouldn’t exceed the first one. An indirect indication of the trend’s strength is the ratio of the bar sizes. If each new candle’s body is larger than the previous one, the trend’s strength increases. If the bars are progressively getting smaller, especially together with increasing shadows, expect the movement in the current price direction to end soon.

Heikin-Ashi Formula: A Better Candlestick – Investopedia

Heikin-Ashi Formula: A Better Candlestick.

Posted: Tue, 28 Jun 2022 07:00:00 GMT [source]

With the emergence of a bullish trend, traders with short positions may exit, while those with long positions should increase and consolidate their positions. Heikin-Ashi’s price values will vary from those on a candlestick chart. Hence, traders can ride the trend profitably due to the credibility of the Heikin-Ashi trend signal. With the emergence of a bullish trend, traders with short positions may exit while those with long positions should increase and consolidate their positions.

Advantages Disadvantages of Heikin Ashi

Traders who have shorted a market might consider this as a signal to start looking to exit their respective bearish positions. Most traders use price gaps to analyze price momentum, trigger entries, or position stop-loss orders. Although Heikin-Ashi lacks price gaps, traders can counter such a limitation during a trading session by temporarily switching to traditional candlesticks.

- Traders who have shorted a market might use these HA signals as indications to hold on to their positions in an attempt to maximise gains during a bearish trend.

- The trick is to use tools that may provide an objective perspective for a trend change while it’s occurring, not well after the fact.

- This can be done by looking for support and resistance levels, as well as looking at the Heikin Ashi candles.

- Just read this blog and you will be able to analyse the candlestick trend more clearly.

Taking this signal into account, exit the market with a profit at the opening of the next candle. Heiken-Ashi’s scalping strategy involves a very simple analysis. In particular, if the next bar forms in the desired direction by the Price Action signal, it’s enough to enter. Here, almost every Heiken-Ashi candlesticks has a noticeable lower tail. After the pattern is formed, the bearish trend pauses and then changes to the bullish one.

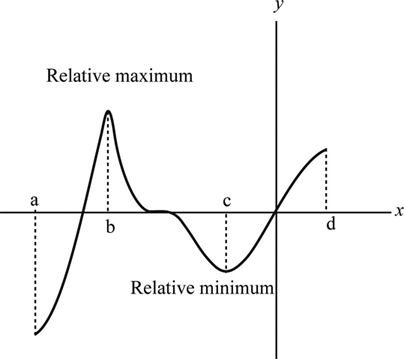

With the figure above the Heikin Ashi chart shows an example of different patterns. We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools. We’re also a community of traders that support each other on our daily trading journey. For beginner traders, this means that the trend is easier to see. The next chart shows Monsanto (MON) with a classic correction in June 2011.

A trader can avoid losses and profit by entering a new trade instead by identifying a reversal signal. As with any other candlestick chart, you set the timeframe to whatever you choose. If you select a daily chart, the Heikin-Ashi values are defined for the day’s open, close, high, and low. If you choose an hourly chart, the Heikin-Ashi values are defined for each hour’s open, close, high, and low.

Here, there are more red candles that formed with small or no upper tails. If the upper border is broken during the previous uptrend, open a long position since the uptrend will continue. If the price breaks the lower border, expect a reversal, and open a short position.

How to Use a Heikin Ashi Chart

Since the buying pressure begins to rise and all conditions for a buy trade are met, open a position at the Heikin Ashi close to the bar marked with a blue oval (blue line). Set a stop loss at the closest Heikin Ashi low of the Japanese candlestick and a trailing stop with an offset (distance between the entry level and the stop loss). At the same time, they give enough confidence to go for an aggressive market entry. Our predictions are confirmed when the price breaks the upper border (green circle). At this point, the buying pressure starts to rise and you can open a buy trade (green line).

The emergence of candles with small bodies is a signal that traders should be aware of and take notice. These candles are used to signal when a trend is about to pause or reverse. Hence, when traders notice this, they move to open new positions in response to an ending trend.

Filtering of market noise

Just read this blog and you will be able to analyse the candlestick trend more clearly. The HA close is the average of the actual high, low, open, and close price for the period for the asset. However, heikin ashi bars could get you closer to getting the information you need to make an informed decision.

While these principals are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. TD Ameritrade does not recommend the use of technical analysis as a sole means of investment research. Chico Span (blue line) heiken ashi reversal patterns is above the bar and directed upwards. To show that the Chico Span lows are rising, I connected them with a black line. Senkou Span A (green curve) exceeds Senkou Span B (red curve). Stop loss is usually set at the nearest local minimum of the Japanese candlestick.

News & Analysis

Thus, Heikin Ashi is useful, important and a clearer version of what traditional candlesticks have to offer. We are here to guide you about the advantages that Heikin Ashi candlestick patterns bring to the table. Thus, using the Heikin Ashi formula can help traders to read the chart easily with average price determination. This information has been prepared by IG, a trading name of IG Markets Limited. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information.

- We understand your insecurity about knowing and implementing a formula, but trust us, it is one of the easiest and most useful formulas to learn in technical analysis.

- Options trading subject to TD Ameritrade review and approval.

- If you answered yes to any of the questions, you’d benefit from the Heiken-Ashi chart.

- Heikin Ashi might have several advantages, but it has a few disadvantages as well.

- Most traders use price gaps to analyze price momentum, trigger entries, or position stop-loss orders.

The chart below shows Apache (APA) falling with a string of filled candlesticks in late October. The Heikin-Ashi candlesticks formed a falling wedge and APA broke resistance with a surge in early November. A triangle consolidation then took shape as the stock consolidated in November. The upside breakout signaled a continuation of the bigger uptrend.

But we don’t see any signals of a reversal, and the bar itself doesn’t have a large range (purple circle). Instead of closing, monitor the market because the drop in the Heikin-Ashi chart may be a short-term correction. This forms when the opening and closing prices are almost the same.

Stay in Strong Trends with the Heikin-Ashi Candlestick – DailyFX

Stay in Strong Trends with the Heikin-Ashi Candlestick.

Posted: Wed, 03 Sep 2014 07:00:00 GMT [source]

Heikin-Ashi is useful for short-term trading strategies, whether day trading or swing trading. It can be used in any market, including Forex, stocks, commodities, and indices. This chart type and indicator helps traders to spot trends and stay in winning trades. However, before using it, traders must understand how it works, as averaging prices can also produce pitfalls. Identifying candlesticks with no shadows is a very credible signal that a strong bullish trend is starting.

By comparing them visually, you can see that the lower chart is smoother. It shows no gaps, and many bars are opened closer to the middle level of the previous bars. Prices extended higher until the stock stalled around 110 in July. Two doji and an indecisive candlestick formed in mid-July (3).

The green arrow shows a strong advance marked by a series of Heikin-Ashi candlesticks without lower shadows. This means the Heikin-Ashi open marked the low and the remaining data points were higher. The Heikin Ashi Candlesticks also help traders identify when to enter or exit the market by providing the strong bullish or bearish trend reversal points in the chart. As soon as a bullish trend emerges, traders exit their short positions and take long positions to maximise profits.

Heikin-Ashi is a Japanese charting method that originated in Japan in the 18th century. The technique was originally used to trade rice futures, but it has since become popular in trading other financial instruments. First, understand that each candlestick will tell you something about the price trend.