Read how Kia enabled innovation in design reviews, on a global scale, with the help of VRED and VR collaboration. We support ~10 new market roll-outs with market-specific pricing, shipment, discounts & interfaces (e.g. Arabic) yearly. We delivered & integrated a set of client-server applications for Knorr-Bremse Autonomous Yard Maneuvering solution.

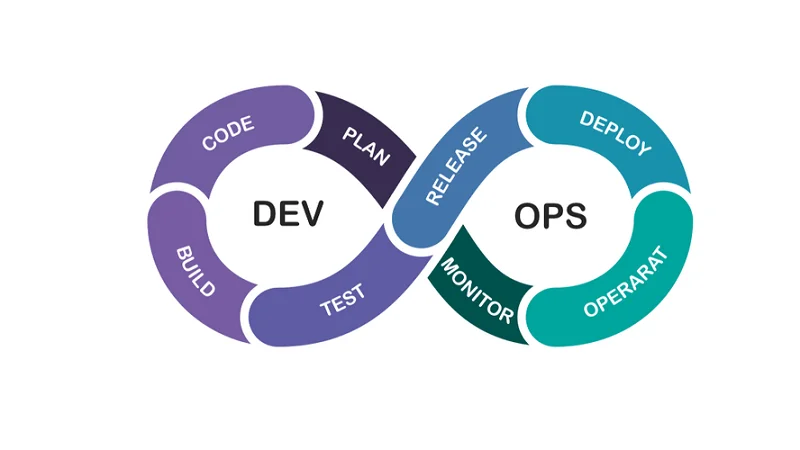

As software complexity increases, automotive players must upgrade their performance-management systems using standardized, data-driven metrics for productivity, project maturity, and quality. Only automated, data-driven insights can enable a real-time, fact-based performance-management approach and proactively reveal looming software issues concerning time, cost, and quality. The first dimension—what software is developed—focuses on reducing complexity through modular and decoupled hardware/software architecture, user-centered design, and requirements management. The other three dimensions focus on increasing the efficiency of software development by providing the right structures, processes, and infrastructure. We have identified 11 best practices across the four dimensions that can help automotive players successfully master their software challenges (Exhibit 3). Some are developing in-house talent and capabilities (for example, BMW’s Car-IT and, more recently, Volkswagen’s Car.Software.org8).

Autodesk Alias

Onboard diagnostic tools and Telematics Systems that collect data from various sensors in the vehicle, to help monitor vehicle performance, Emissions check, and capture vehicle telematics, among others. Often, the number of toolchains https://www.globalcloudteam.com/ and tools used will increase to unmanageable levels, reducing transparency. To avoid this problem, experienced toolchain managers should regularly review the tool landscape and take corrective actions when needed.

Software and electronics have therefore become the focus of most automotive companies and their executives. Automotive OEMs must develop and refine their strategic perspective based on their resources, capabilities, and industry positions. In response to increasing per-vehicle hardware and software costs, OEMs can consider partnering with other OEMs to create economies of scale, making software reusable across platforms, and simplifying the E/E architecture.

Application Development

With software volumes increasing and greater demand for continuous feature updates, OEMs must find and resolve bugs and interface errors as soon as possible. If they fail to resolve an error directly, they may create a massive backlog of bugs that could fully absorb their resources and complicate error tracing, causing development delays and increased verification efforts. automotive software development Of course, companies must also consider the ease of sourcing from the market during make-versus-buy decisions. To improve decision making, OEMs can weigh each factor based on their priorities and the market context. While automotive organizations must excel on many levels to win the software game, attracting and retaining top talent is probably the most crucial dimension.

Cross-functionality would benefit tier-one suppliers too, and so would actively partnering with OEMs to define their E/E architectures. Tier-two suppliers will want to specialize further and scale within an attractive niche to thrive even as many components become commodities. Making up the largest share of the market, electronic control unit (ECU) and domain control unit (DCU) sales are expected to reach $144 billion by 2030. The second-largest share of the market will be software development (including integration, verification, and validation), with a revenue potential of $83 billion by 2030.

‘How’: Productivity boosts and software-development methodology

For instance, drivers must now deal with clunky, lag-filled interfaces that are slow to respond to their inputs, since infotainment systems must wait to receive information from other components. There are also disconnects (such as a lack of coordinated information between instrument clusters and center screens on some vehicle models) and an absence of visual consistency for indications and alerts. These issues are not only distracting but also disappointing to consumers accustomed to streamlined, user-friendly interfaces in mobile phones and tablets—devices that cost far less than a car does. Hackers have proved their ability to access locks, brake systems, and dashboard displays remotely via the cloud connections in several models.

Security could greatly expand, enabling one overarching solution to monitor the full code base—not just at a handful of interfaces. And development productivity could considerably improve, with OEMs adding new cross-domain features over time, without extensive software rewrites, by leveraging a common code base throughout the vehicle. Today’s hardware-defined cars are rapidly transforming into software-defined transportation platforms.

In-vehicle Infotainment Systems

Under this model, product-specific projects are staffed with individual members of the technology organization. This approach achieves the required focus on the technology and role dimensions through dotted lines and mature processes. While this model fosters deep technology and domain expertise, it provides little flexibility regarding project scope, requirements, and specifications, even if these change during the project. Organizations typically follow this archetype when they develop and maintain numerous products.

Established OEMs are likely to take note of this proof point and could follow a similar model for their next vehicle platforms. Shifting to a software-centric mind-set could simply mean defining and maintaining the core end-to-end foundation and insisting upon adherence as part of the supplier-relationship construct. Although this represents a fundamental shift in approach, it is likely to prove to be a critical lever against the threat of disruptive OEMs. LightWave is a leading car design software that offers powerful modeling tools with the ability to create smooth subdivisions surfaces interactively. The result has been the release of more cars with continuously updating software features. Tesla was the first company to bring over-the-air software updates to the mainstream.

Services

Such efforts will require sustained change management, but they will help automakers become software powerhouses. OEMs might compete for market share, but partnerships among traditional rivals are well known in the space, especially when companies have a common interest. For instance, three German OEMs formed a consortium to acquire a mapping business, then worked together to improve the system for automotive use. Each company occasionally added proprietary mapping features, such as improved user interfaces, to its own cars to provide a competitive advantage.

- Many players have started to introduce software product line engineering (PLE) to increase reuse and handle product variation.

- There are also disconnects (such as a lack of coordinated information between instrument clusters and center screens on some vehicle models) and an absence of visual consistency for indications and alerts.

- Additionally, OEM collaborations would decrease reliance on tech powerhouses for software.

- Advanced Driving Support System (ADAS) warns the drivers about the situations coming ahead, like stop signs, pedestrian zones, etc.

- From runtime and embedded software, real-time drivers, MATLAB/Simulink®-compatible toolboxes, ISO compatible safety software, to auto code generation support to AUTOSAR abstraction layers and operating systems (OS).

The automaker is also submitting the new definition to the Connected Vehicle Systems Alliance (COVESA), a global alliance focused on the development of open standards and technologies for connected vehicles. With our reliable keyless vehicle access systems, the development and implementation of our NFC technology solutions will take less time and resources. Modern car telematics and cloud solutions enable vehicles and fleets to stay safely connected and routed. Connectivity is the foundation for advanced mobility services and predictive maintenance. Our embedded, wireless connectivity experts help you develop, test and troubleshoot Cellular (3G/4G/5G and NB-IoT), Wi-Fi and Bluetooth solutions related to in-vehicle and radio access. The cost and number of cars produced used to be key factors of commercial success, but now it will be the ability to create a scalable organization that follows a similar growth pattern to a technology company.