Fixed costs are the opposite of variable costs, which fluctuate depending on how many goods your business produces or how many services you provide. You should factor this into your calculations to ensure that your business remains financially stable in the long run. Maintaining a record of your business’s expenses is critical to calculating accurate fixed costs.

As such, a company’s fixed costs don’t vary with the volume of production and are indirect, meaning they generally don’t apply to the production process—unlike variable costs. The most common examples of fixed costs include lease and rent payments, property tax, certain salaries, insurance, depreciation, and interest payments. Fixed cost vs variable cost is the difference in categorizing business costs as either static or fluctuating when there is a change in the activity and sales volume.

Is Marginal Cost the Same as Variable Cost?

For example, a barber will have to pay rent whether they cut one persons hair or twenty people. This may increase in line with inflation, but is fixed for a set period of time. Effectively, the factory has a value as an asset during the 10 years – until it is no longer productive. As it could potentially be sold on and produce output for x number of years, it still has a value. So although it may cost $10 million to buy, it is still seen as an asset in accounting terms. In other words, $10 million isn’t spent but rather invested in an asset – shares are a similar example.

You would still continue to pay for rent, insurance and other overhead expenses. The implication of high fixed costs for a company is a demand for similarly high production output or revenue to maintain profitability. Fixed cost is paired with its opposite, variable cost, in evaluating the total cost structure of a company. When factors like sales commissions are factored into per-unit production costs, sales and production levels can impact variable costs. On the other hand, even if production is significantly slowed, fixed costs still need to be paid. A comprehension of fixed and variable costs can be used to determine economies of scale.

Variable cost is a type of cost that fluctuates based on the level of production and sales within a business. These costs are directly related to the production or sale of a product or service and can include expenses such as direct materials, direct labor, and variable overhead. Another important aspect of fixed cost analysis is analyzing cost-volume-profit (CVP) relationships. CVP relationships help managers understand the relationship between sales, costs, and profits. By analyzing CVP relationships, managers can determine the impact of sales volume, price, and cost changes on profits.

What are fixed costs?

That is a huge expense, particularly if the airliners only fill up half the plane. In turn, these high fixed costs can dissuade potential competitors from entering the market. A fixed cost will change over time due to situational factors that are not impacted by a firm’s activity (e.g., rent or taxes may change). But it’s also important to understand that increasing production can also help you lower your costs, resulting in even greater profits. So in keeping with our bakery example, as sales steadily rise, each cake will eventually cost less to produce. Variable costs for a furniture maker could include raw materials, wages, packaging, and gas for delivery trucks.

- Companies have some flexibility when it comes to breaking down costs on their financial statements, and fixed costs can be allocated throughout their income statement.

- Ingredient costs could change as well—an unfavorable year for wheat could raise the cost of flour.

- These costs are likely attributed to your food truck monthly payment, auto insurance, legal permits, and vehicle fuel.

- It could be argued that this is variable, as insurance costs can increase as the firm gets bigger.

This is the clear distinction between these two different types of costs. Fixed costs are those that can’t be changed regardless of your business’s performance. Your company’s total fixed costs will be independent of your production level or sales volume. For example, rent payments are due monthly, whether the business produces ten products or ten thousand. This makes it easier for a company to determine its fixed cost, as the total amount does not change for a specific period. Fixed cost refers to business expenses that do not change regardless of the production or sales volume level.

Solutions and Services

This erroneous approach underestimates fixed costs and could harm the company’s profitability and decision-making. As stated earlier, fixed costs are expenses that remain constant regardless of the level of production or sales. While they are necessary to operate a business, fixed costs are not without their limitations. Here is a list of six of the significant limitations of fixed costs. For instance, if fixed costs are already high, expanding production may not be financially viable. This will lead to a significant increase in variable costs, such as material and labor expenses.

If you know your fixed costs will be close to the same year after year, you can project what they will be in five or ten years. When you do this, you must also account for more complex factors such as asset depreciation. Fixed costs are not linked to production output, so these costs neither increase nor decrease at different production volumes. Fixed costs are output-independent, and the dollar amount incurred remains around a certain level regardless of changes in production volume. For example, let’s say that Company ABC has a lease of $10,000 a month on its production facility and produces 1,000 mugs per month.

Fixed costs are permanently fixed- Common Misconceptions of Fixed Cost

If a business takes up such an option, this can count as a fixed cost. A charge on the loan is due every month or year, independent of how much goods the business produces and sells. Fixed costs are independent of the number of goods or services produced; variable and total costs depend on the number of goods or services produced. Depreciation, rent, insurance, advertising, and plant superintendent’s salary are examples of a fixed costs. Total fixed costs are shown by a straight line drawn parallel to the x-axis because fixed costs do not respond to changes in volume or activity.

Understanding the difference between the two can help you make better decisions about your cash flow, expenses, and the impact they have on profitability. When business owners want to increase profits and make more money per sale, they often look at lowering their cost of goods sold, including variable costs. Examples of variable costs include the costs of raw materials and labor that go into each unit of product or service sold. To find your company’s fixed costs, review your budget or income statement. Look for expenses that don’t change, regardless of your business’ quantity of output. Any costs that would remain constant, even if have zero business activity, are fixed costs.

How to calculate total fixed costs

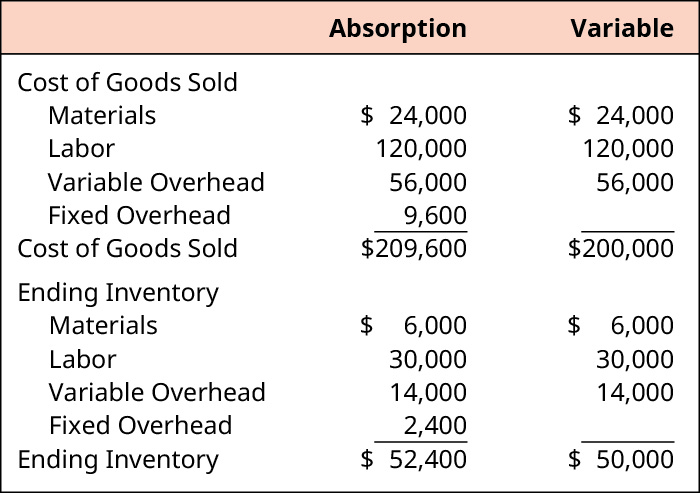

Variable costs are inventoriable costs – they are allocated to units of production and recorded in inventory accounts, such as cost of goods sold. Fixed costs, on the other hand, are all costs that are not inventoriable costs. All costs that do not fluctuate directly with production volume are fixed costs. These costs include indirect costs and manufacturing overhead costs. Some cost accounting practices such as activity-based costing will allocate fixed costs to business activities for profitability measures.

The equation can assist them in calculating the number of units and dollar volume required to generate a profit and determining whether these figures are credible. Depreciation is the decrease in the value of an asset over time due to wear and tear. Many companies make the mistake of overestimating or underestimating the depreciation value of their fixed assets, such as equipment, vehicles, or buildings. Profits don’t skyrocket after all the fixed costs are covered, as they do with high-fixed-cost ventures. Companies can produce more profit per additional unit produced with higher operating leverage.

A business is sometimes deliberately structured to have a higher proportion of fixed costs than variable costs, so that it generates more profit per unit produced. Of course, this concept only generates outsized profits after all fixed costs for a period have been offset by sales. One of the most common mistakes businesses make is confusing fixed costs with variable costs.

Top misunderstandings about tax-deductible expenses – St. James’s Place

Top misunderstandings about tax-deductible expenses.

Posted: Wed, 23 Aug 2023 08:50:09 GMT [source]

Secondly, fixed costs provide a certain level of stability and predictability to business operations. Even during low sales or downturns in the market, a business can still cover its fixed costs and continue to operate. Thus, fixed costs help reduce uncertainty and allow companies to plan for the long-term more confidently. The break-even point is the required output level for a company’s sales to equal its total costs, i.e. the inflection point where a company turns a profit.

What Are the Factors That Affect a Company’s Fixed Cost?

Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Your electric bill, for example, might increase a little during warmer months due to increased air conditioning usage, but, month to month, there should be little change. Our editors will review what you’ve submitted and determine whether to revise the article. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. Here, the concept of the relevant range is critical; it refers to the range of activity that the company expects to operate in.

You might even need to hire part-time, seasonal employees to help you meet the demand. If business increases substantially, you’ll find that your variable costs increase alongside your profits. Because fixed costs are stable in the short term, they’re relatively easy to project and include in your budget.

This includes tracking invoices, receipts, and other documents related to the cost of goods sold. Furthermore, effectively managing fixed costs can help maintain a competitive edge in the market. By reducing costs, businesses can offer more competitive pricing or invest in product innovation and marketing, attracting more customers and increasing What is fixed cost market share over time. As a business owner, encountering an increase in fixed costs can be a challenging experience. When fixed costs increase unreasonably, the financial stability and viability of the business can be significantly affected. Fixed costs can also be a burden when businesses do not operate at maximum capacity.

The difference between the total revenue and the operating costs is the business’ operating income. Your variable unit costs are $1 which includes paper coffee cups, coffee beans, and milk for spinning up lattes. You need to sell 1,135 hairbrushes every month to break even, and any brushes sold beyond that break-even point will generate profits for your business.