However, software like QuickBooks has made it much easier for business owners to keep track of their entries, making reconciliation much more painless. Since QuickBooks automatically matches credits and debits between your books and the bank, reconciliation is just an opportunity to triple-check your work. An example of a principle error might be buying a piece of equipment and miscategorizing the expense as a sale instead of a purchase. Such a snafu could wreak havoc on your checks and balances when it comes time to reconcile your financial statements.

Transposed-word effects in speeded grammatical decisions to … – Nature.com

Transposed-word effects in speeded grammatical decisions to ….

Posted: Wed, 21 Dec 2022 08:00:00 GMT [source]

With a check digit, one can detect simple errors in the input of a series of characters (usually digits) such as a single mistyped digit or some permutations of two successive digits. Verhoeff had the goal of finding a decimal code—one where the check digit is a single decimal digit—which detected all single-digit errors and all transpositions of adjacent digits. At the time, supposed proofs of the nonexistence[5] of these codes made base-11 codes popular, for example in the ISBN check digit. If $737 is a transposition of $773, correcting it will increase total credits, so it is marked with an I. This account cannot be the cause of the problem because the difference is only 36, not 360.

Strategies for transposition errors: Here is how you may transpire out!

Accounting errors normally discovered through mathematical mistakes, mistakes from applying accounting policies, misinterpretation of facts of transactions, lack of oversights, and fraud. An indication of a possible transposition error is if the discrepancy between two records or statements is divisible by 9. The strengths of the algorithm are that it detects all transliteration and transposition errors, and additionally most twin, twin jump, jump transposition and phonetic errors. There are many ways to prevent and spot accounting errors before they can slow you up. The main point to remember when looking for accounting errors is maintaining the essential bookkeeping principles. The easiest way to prevent any changes after close and avoid closing errors is to set a closing password.

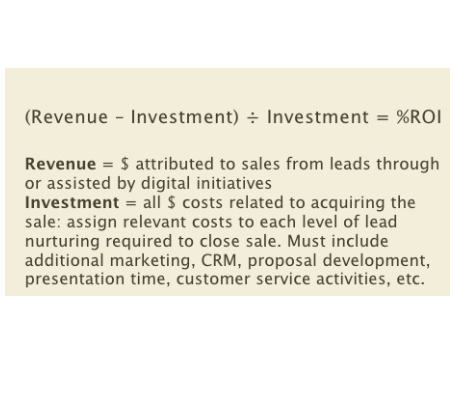

This should be checked by proofreading; some syntax errors may also be picked up by the program the author is using to write the code. A transposition error in the context of business and finance is a significant concern because it pertains to the inadvertent swapping of numbers during data or financial information entry. This seemingly small error can significantly impact the accuracy of financial statements and ledgers, leading to inconsistencies in accounting records. These errors can distort a company’s financial health representation, leading to inappropriate decision-making by stakeholders, erroneous tax filings, and financial audits. Here’s an example from Mastering Correction of Accounting Errors, Section 3 – Finding and correcting errors using the unadjusted trial balance. To determine if it’s a transposition error, find the difference ($1,810 – $1,180).

Transposition Error

Until then, your balance as per the cash book would differ from the balance as per the passbook. In such a case, your bank has recorded the receipts in your business account at the bank. As a result, the balance showcased in the bank passbook would be more than the balance shown in your company’s cash book. However, there may be a situation where the bank credits your business account only when the cheques are actually realised.

- Keep in mind that transposition errors aren’t just limited to accounting books.

- At the time, supposed proofs of the nonexistence[5] of these codes made base-11 codes popular, for example in the ISBN check digit.

- Such a time lag is responsible for the differences that arise in your cash book balance and your passbook balance.

- Nathan L. Collis[2] studied the nature of visual-spatial attention deficits in dyslexia adults.

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Transposition errors also describe scenarios where bookkeepers enter spreadsheet data into the wrong cells. Transposition errors made in the trading world are sometimes called “fat-finger trades.” In one famous example, a Japanese trader accidentally ordered 1.9 billion shares in Toyota.

Direct Deposits into the Bank Account

The following example shows how to tell if there is a transposition error. For purposes of illustration, a partial trial balance is shown using account balances without the account titles. Before the arrival of printing, the copyist’s mistake or scribal error was the equivalent for manuscripts. Most typos involve simple duplication, omission, transposition, or substitution of a small number of characters. This, along with double-checking your work, can make all the difference between correcting your mistakes and letting them fall through.

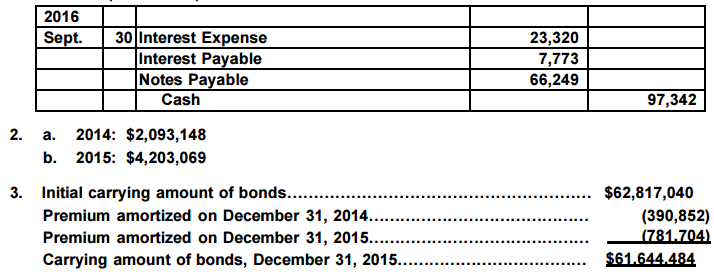

“Transposition error” may be confused with “transcription error”, but they do not mean the same thing. As the name suggests, transposition errors occur when characters have “transposed”—that is, they have switched places. This often occurs in the course of transcription; thus a transposition error is a special case of a transcription error. I record the following correcting journal entry to decrease both the utilities expense and accounts payable by $45. Trial balance errors cause inaccuracies on your balance sheet and income statement.

Auditing transcription errors in medical research databases

It goes without saying that over or under-compensation doesn’t look good on the books, but it’s also not good for rapport within your organization. Employees Transposition error want to trust they will be paid correctly and on time from your company. Too many incidents like this may create distrust in your accounting system.

Get up and running with free payroll setup, and enjoy free expert support. The employee’s hourly rate is $21 per hour, but you accidentally enter $12. Not only does this mistake result in lower wages for your employee, but it also leads to costly tax miscalculations. Now let’s pretend you go to invoice the customer for the Accounts Receivable above. You skim over your journal entries and see the $1,180 you accidentally wrote down.

Step #5: Record All The Adjustments As Per Cash Book Into Your Company’s General Ledger Cash Account

Taking manual entry out of bookkeeping can drastically reduce the likelihood of transposition errors. A good first step is letting your accounting software and bank account speak to each other. Now that you know what is transposition in accounting, you might wonder where these errors can occur. Transposition accounting might creep into your journal entries, business ledger, financial statements, or invoices. You can also inadvertently flip-flop the numbers of an employee’s wages while writing their paycheck. In addition to this, the interest or dividends earned on investments is directly deposited into your bank account after a specific period of time.

One of the primary reasons responsible for such a difference is the time gap in recording the transactions of either payments or receipts. As mentioned above, bank overdraft is a condition where a bank account becomes negative as a result of excess withdrawals over deposits. After adjusting all the above items, what you get is the adjusted balance as per the cash book.

For example, posting a new transaction on your books after the closing date requires you to repeat the closing process again. Reversing accounting entries means that an entry is credited instead of being debited, or vice versa. The issue is that you can’t spot this mistake in your trial balance—it will still be in balance regardless. Transcription and transposition errors are found everywhere, even in professional articles in newspapers or books. They can be missed by editors quite easily, just as they can be created quite easily. The most obvious cure for the errors is for the user to watch the screen when they type, and to proofread.

The text editor Emacs even has a basic control chord (Ctrl+T) to swap (transpose) the preceding two characters. That simple, easy-to-make transposition error alerts the IRS that your tax deposits don’t match wages paid. If you find a discrepancy in the accounting records, divide the number by 9. If the error is due to transposition, the number will divide evenly by 9. From the following particulars of Zen Enterprises, prepare a bank reconciliation statement as of December 31, 2021. There are times when your business entity deposits a cheque or draws a bill of exchange discounted with the bank.

At times, you might give standing instructions to your bank to make some payments regularly on specific days to the third parties. For instance, insurance premiums, telephone bills, rent, sales taxes, etc are directly paid by your bank on your behalf and debited to your account. Your bank may collect interest and dividends on your behalf and credit such an amount to your bank account.